Are Private Condos Necessarily Better Than Executive Condos?

Written by Seth Tan

In my recent article about Executive Condos (ECs), I briefly mentioned that ECs have shown greater growth potential compared to Private Condos (PCs).

In simple terms, choosing an EC seems like a savvy option if you’re aiming to gain profits when it’s time to sell.

But don’t just take my word for it. I’ve got the latest data on hand, and you know what they say, numbers don’t lie.

Take a journey with me to see what I’ve found.

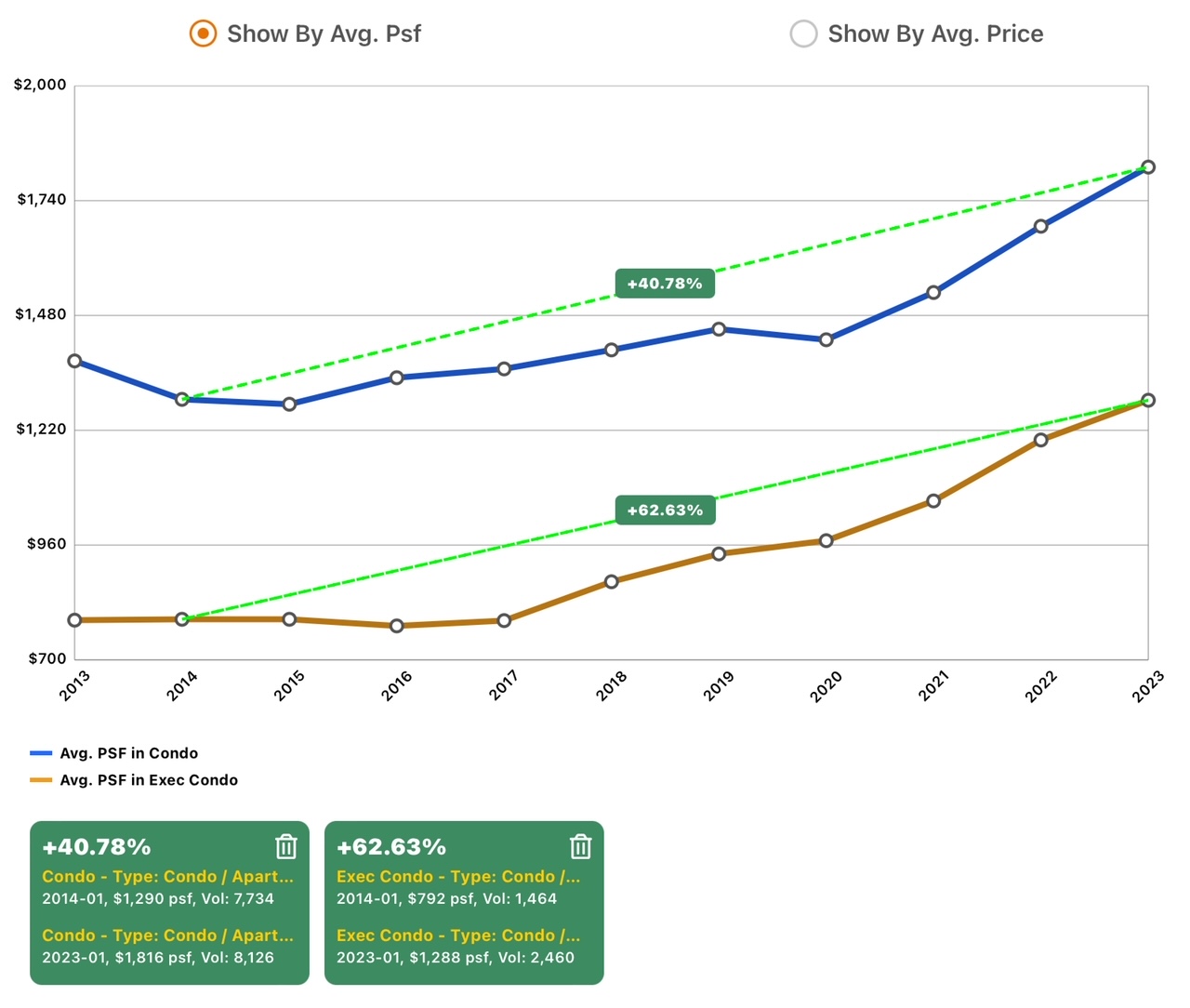

Growth of PCs vs ECs

Take a look at the chart tracking how the cost per square foot ($PSF) has evolved for PCs and ECs in Singapore from 2014 to 2023.

It’s a bit like comparing growth spurts, and guess what?

ECs have outshone PCs by a whopping 22%! Just to break it down differently, PCs had a yearly growth rate of 4%, but ECs breezed past them with a solid 6% growth rate each year.

Historical data also corroborates this fact as the majority of first-time EC owners gained more than $300,000 when selling their property after completing the 5-year Minimum Occupation Period (MOP).

Case Studies

So, I thought: Could it be that the whole EC growth was just an over-generalisation (i.e. Great ECs were pulling up the average for poor ECs)?

To put it to the test, I decided to get a bit granular and zoom in on specific pairs of PCs and ECs that were 1) near (similar proximity to transport, food, amenities), 2) launched at roughly the same year (similar macro and micro market conditions) and, 3) tenure status (99 year leasehold). These similarities were to keep confounding (unexplainable) variables as minimal as possible.

My three case studies were intentionally selected across different corners of Singapore – East, North-East, and North.

Time for a little investigation!

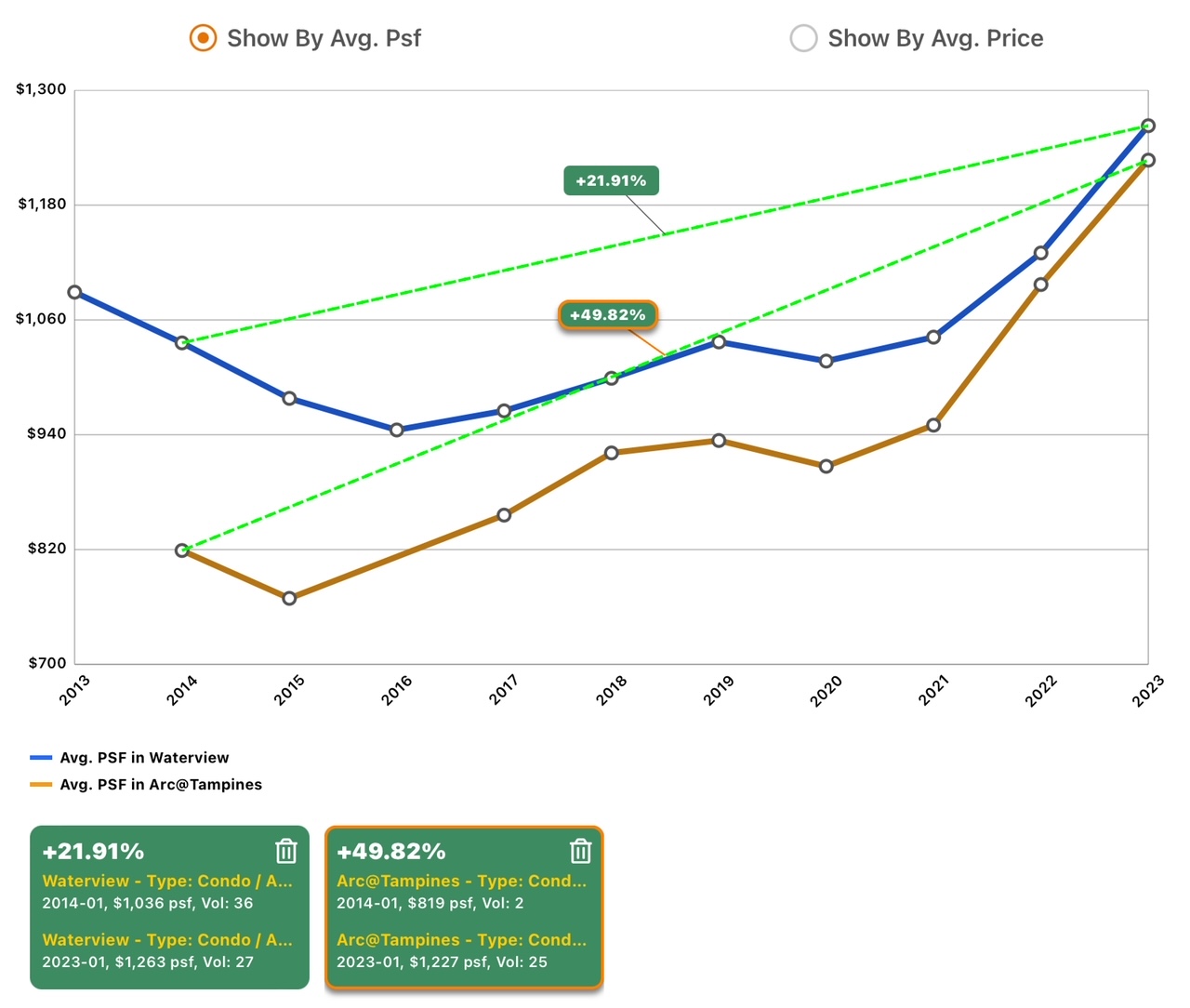

1. Waterview (PC) vs Arc@Tampines (EC)

Waterview: 696 units, 99-years leasehold, completed 2014

Arc@Tampines: 574 units, 99-years leasehold, completed 2014

Taking a trip to the East side, the numbers tell an interesting story. Arc@Tampines has pulled off an impressive growth spurt of 50%, while its counterpart, Waterview, managed a 22% growth over the same 10 year period. That’s more than twice the growth rate for Arc@Tampines.

In fact, we see that the price gap has reduced consistently and by 2023, Arc@Tampines had almost matched Waterview!

Owners at Arc@Tampines gained a profit ranging from $400,000 to $600,000. And the best part? Not a single sale has hit the unprofitable zone so far. The Waterview owners profited around $400,000 to $500,000 which is pretty good too.

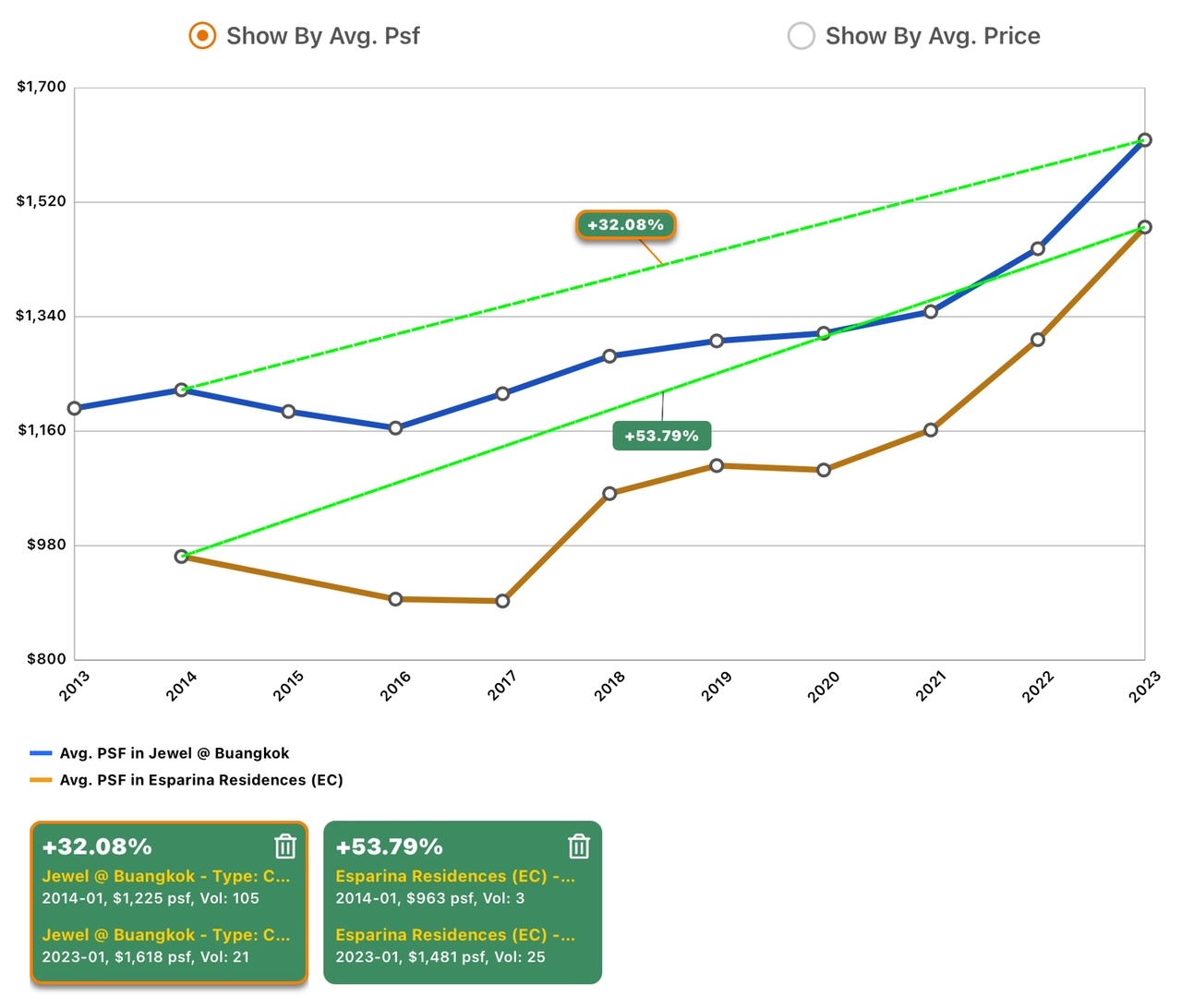

2. Jewel@Buangkok (PC) vs Esparina Residences (EC)

Jewel@Buangkok: 616 units, 99 years leasehold, completed 2016

Esparina Residences: 573 units, 99 years leasehold, completed 2013

Making our way up to the North-East side, we’ve got a pair of condos side by side. From the data, Esparina Residences has grown by 54%, while Jewel@Buangkok grew by a decent 32% over the past 10 years.

Now, let’s delve into the numbers. Recent sales reveal that the early owners of roughly 1000 sqft units at Esparina looked at profits in the range of $700,000 to $800,000. And again, there were no negative sales from Esparina.

On the other side, early owners at Jewel profited in the range of $400,000 to $600,000 with one unprofitable sale.

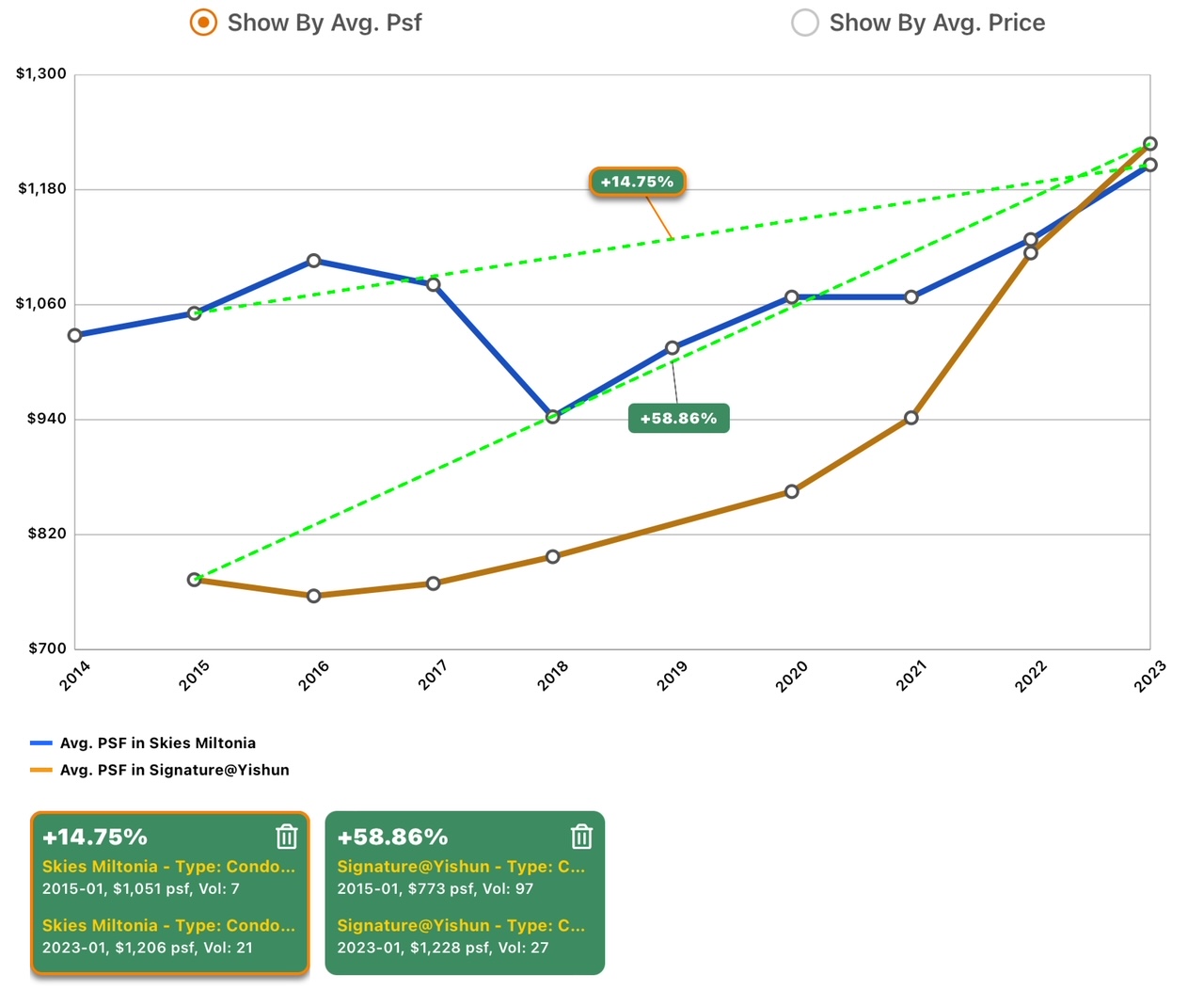

3. Skies Miltonia (Condo) vs Signature@Yishun (EC)

Finally, we head up to the North. After two strong cases, could this be the third one that settles the matter?

Skies Miltonia: 420 units, 99 year leasehold, completed 2016

Signature@Yishun: 525 units, 99 year leasehold, completed 2017

SIgnature@Yishun EC had an impressive 59% growth compared to Skies Miltonia‘s 15% over a 9-year period. Early owners at Signature@Yishun enjoyed profits ranging from $400,000 to $600,000, and again, not a single sale has landed in the unprofitable zone.

For Skies Miltonia owners, early owners profited in the range of $100,000 to $200,000. Unfortunately, there were 52 unprofitable transactions recorded to date.

It appears a consistent pattern is unfolding for PCs and ECs isn’t it?

Conclusion

Now that we’ve studied the overarching growth trends between Private Condos (PCs) and Executive Condos (ECs) and explored three pairs of condos across Singapore, the verdict is clear – ECs emerge as the winner!

Whether you’re seeking a home to settle down in or eyeing a smart investment, ECs undoubtedly stand out. However, there’s a catch – they are in limited supply. There are usually only a few EC launches in a year so be on the lookout for them.

Click here to view current and upcoming EC launches.

Reach out to me today, and let’s work together to secure an EC for you!

Get In touch.