How was the 2023 Property Market?

Before I share about the 2024 Property Market Pulse, how was the 2023 property market pulse like?

2023 was marked with geopolitical tensions, rising costs, macroeconomic challenges and high interest rates (SIBOR peaked at 4.21% on Jan 2023).

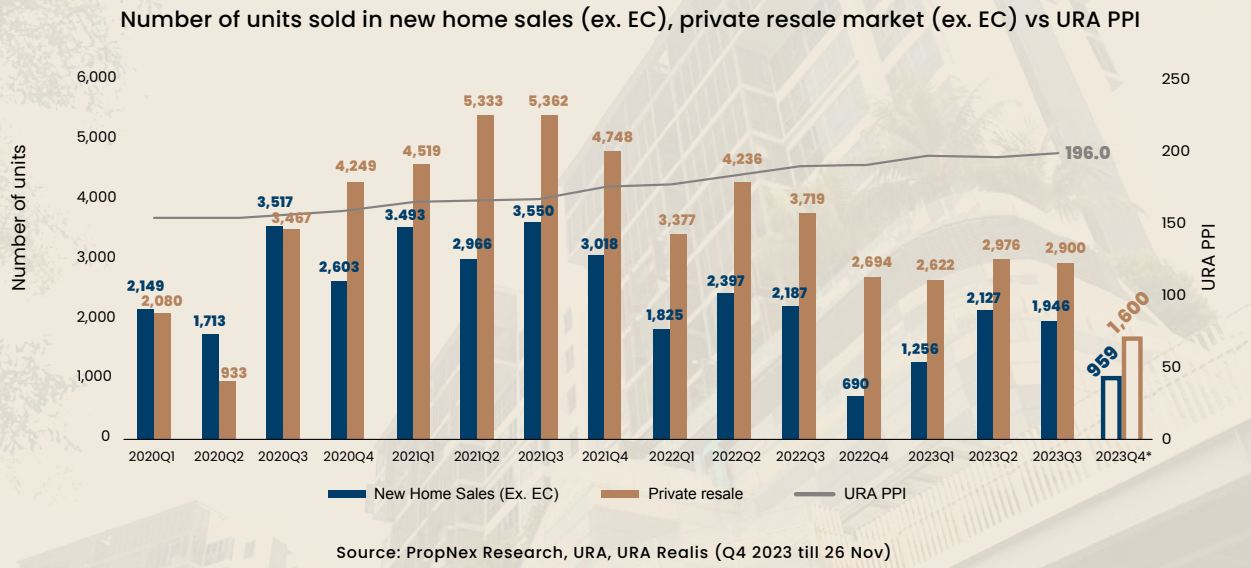

As property prices were soaring, the increased Additional Buyer Stamp Duty (ABSD) rates was introduced in April 2023 as part of the property cooling measure. This had a great impact on the private property segment, especially deterring foreign buyers.

Despite all these, 2023 ended strongly with property prices remaining on the upward trend, and new launch projects like J’den, TMW Maxwell, and Altura EC set new benchmark prices.

The market in 2024 is likely to persist with the ongoing global uncertainties. Nonetheless, there are 5 key changes that we can anticipate for this year:

1. Increased supply of new public and private homes: 2024 will be a buyer/tenant market due to increased supply (BTOs, >30 new launch condos), moderation in price growth and likely interest rate cuts (#2).

2. Interest rate cuts: The US Federal Reserve is expected to have three rate cuts in 2024 (each cut being 0.25%) which bodes well for the economy. Singapore banks might follow suit, spurring buyer affordability and demand.

3. Singapore economy is recovering: Economists are optimistic for 2024, with a tight labour market and low unemployment rates. A good economy will bolster the demand for property due to greater confidence.

4. New home prices are likely to increase: Coupled with high government land sales, construction costs and inflation, this will lead to rising home costs (including BTOs). Even property valuations are increasing as seen in the increased property tax.

5. Implementation of the standard, plus, prime housing model: Launched in 2H 2024, the government’s new model emphasises home ownership and not flipping houses for quick gains. We may see buyers turning to resale flats in mature areas which do not have such tighter restrictions.

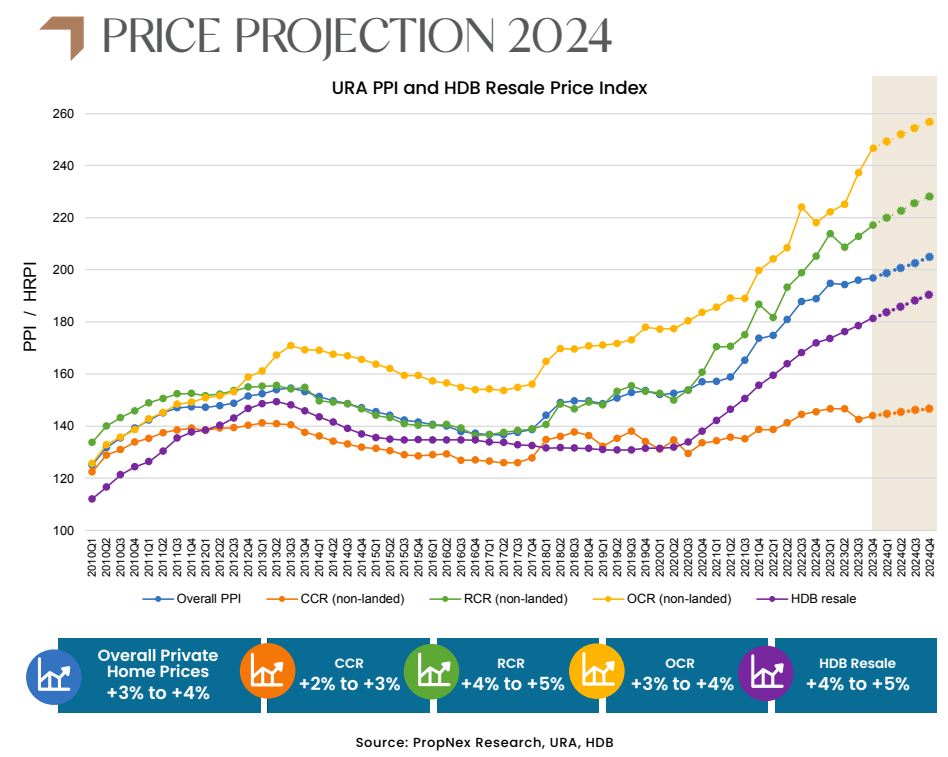

Hence, overall property prices will continue to grow in 2024, estimated at 3-5%.

Let’s focus on the individual market segments and learn how to take advantage of the opportunities in store.

Private Residential Property Market

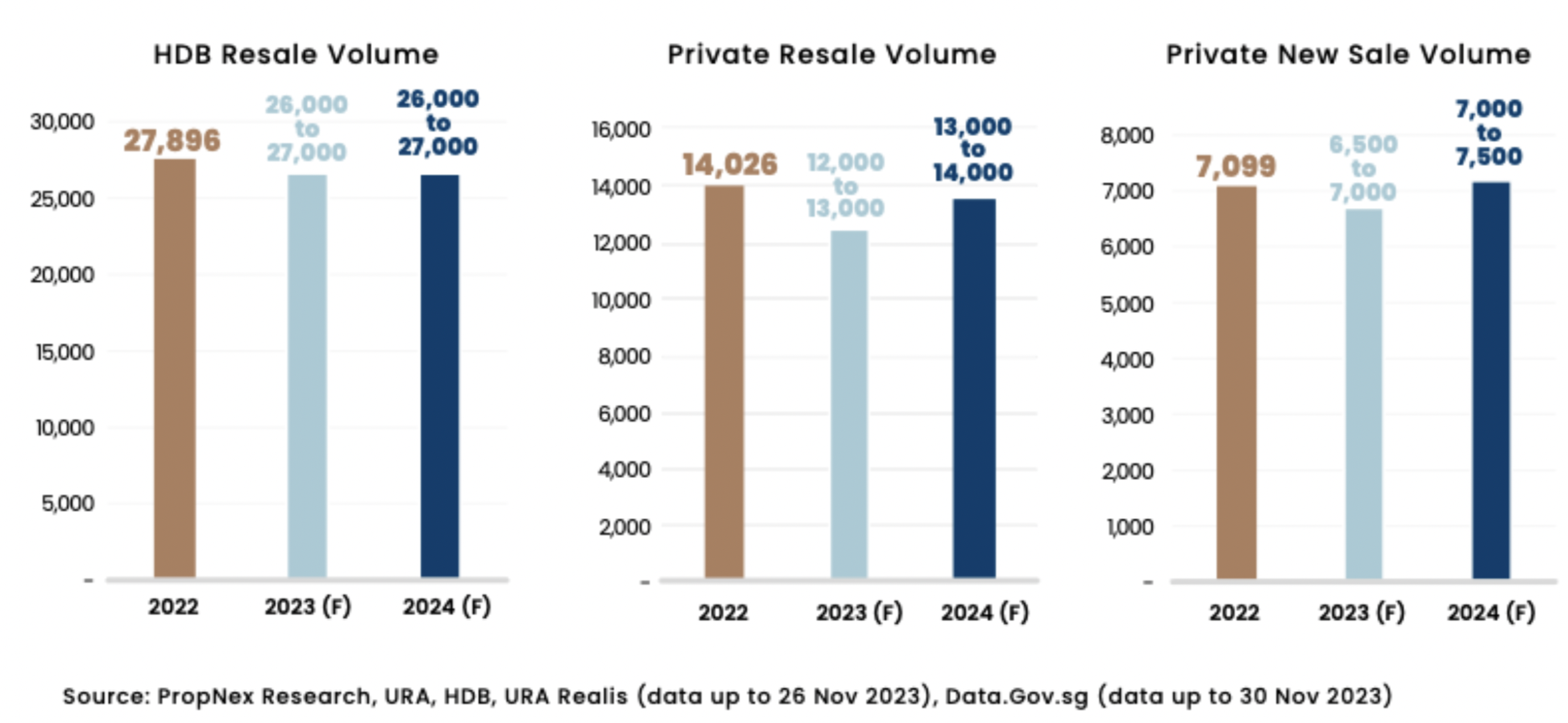

We forecast a 3% to 4% growth in private home prices for 2024. Due to high land prices, rising construction costs, elevated interest rates, and new rules for gross floor area definitions, buyer sentiment has mellowed. Interestingly, even with lower transaction volumes, property prices have risen.

This phenomenon is expected to continue at least into the first half of 2024.

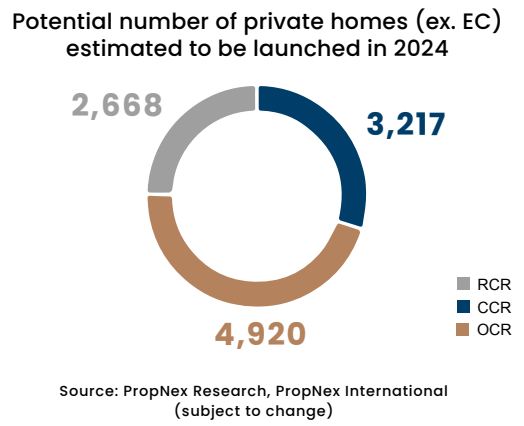

Over 30 projects with more than 10,000 residential units could hit the market in 2024, with the Outside Central Region contributing nearly 46% of the supply.

Resale properties are expected to maintain stable demand due to their affordability, with a 50% average price gap with new launches.

Landed home sales may be slow due to economic uncertainties, but prices are expected to remain resilient due to its scarcity.

My advice is to buy new launch condos in the 1st half of 2024 before the economy picks up in the 2nd half of 2024.

Why?

1. While interest rates are high, buying a new launch with progressive payment will not cost you much from the start. However, you might instead choose to buy a resale private if you have prefer to move in/rent at once.

2. Get in before the trend starts. When interest rates are cut and economy is booming, what happens to demand? Demand will go up and so will the price. Don’t miss the boat and pay more than the early entries.

3. Missed profits when you wait for interest rates to drop. Let’s say you save $50k in interest by waiting till 2027 for interest rates to drop before buying (3 years). What if you could profit $100k by buying a new launch in 2024 and exiting in 2027? Should you still wait?

Do you want to get ahead of the crowd or be part of the crowd?

HDB Resale Market

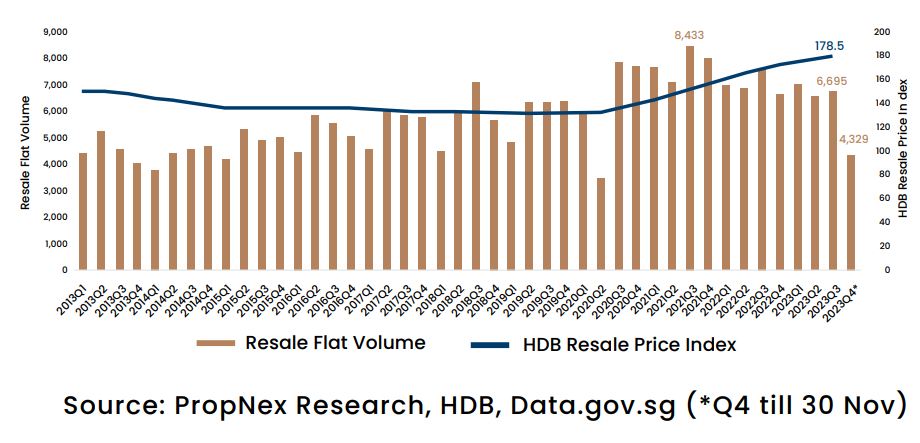

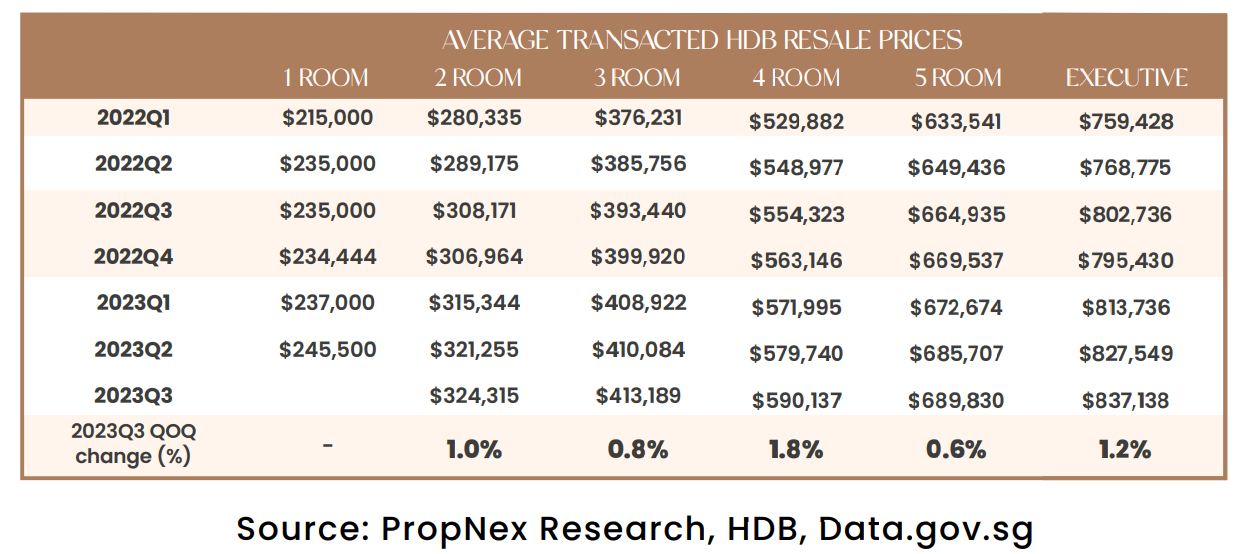

In 2023, the HDB resale market maintained its upward trajectory, with prices increasing.

For 2024, we anticipate more moderate price growth of 4% to 5%. The number of million-dollar resale flats is expected to elevate due to their perceived value compared to expensive private homes. Additionally, this growth will be spurred on by ex-private homeowners who have ended their 15-month wait period and are entering the market cash-rich.

However, increased flat supply have moderated price growth, with plans to launch up to 100,000 BTO flats by 2025. This might draw people away from resale flats to BTOs in mature estates and desirable locations, with shorter waiting times.

In the second half of 2024, new flats will be classified under a “Standard, Plus, and Prime” framework, with stricter resale/rental conditions for Plus and Prime flats (e.g. 10-MOP, clawback subsidies, income ceiling). Prospective buyers may be deterred by these restrictions, leading to increased demand for resale flats and potentially raising prices near Plus/Prime areas.

These measures present a shift from HDB flats as an asset for wealth creation to home stay. With that being said, I believe BTOs are still the most affordable purchase with a higher likelihood for upgrading later. If you don’t like to wait, there is a trend among younger people who are buying older flats due to its lower costs, bigger spaces (and accepting the fact that older resale flats are depreciating assets too).

If you’re planning to sell your HDB in 2024, I believe it’s a good time as prices have peaked. But I feel that it may take a longer time because of the increased supply of flats. Sellers will need to price competitively (i.e. realistically) and not expect prices to rise indefinitely as the government has already reminded us.

Residential Rental Market

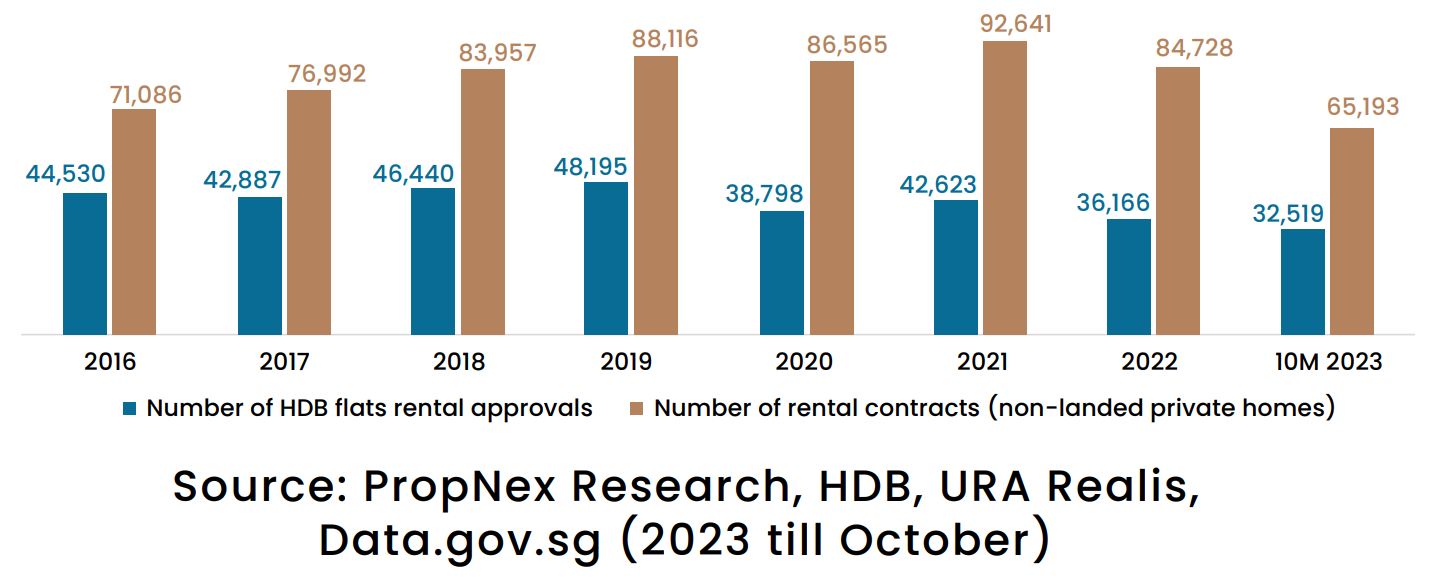

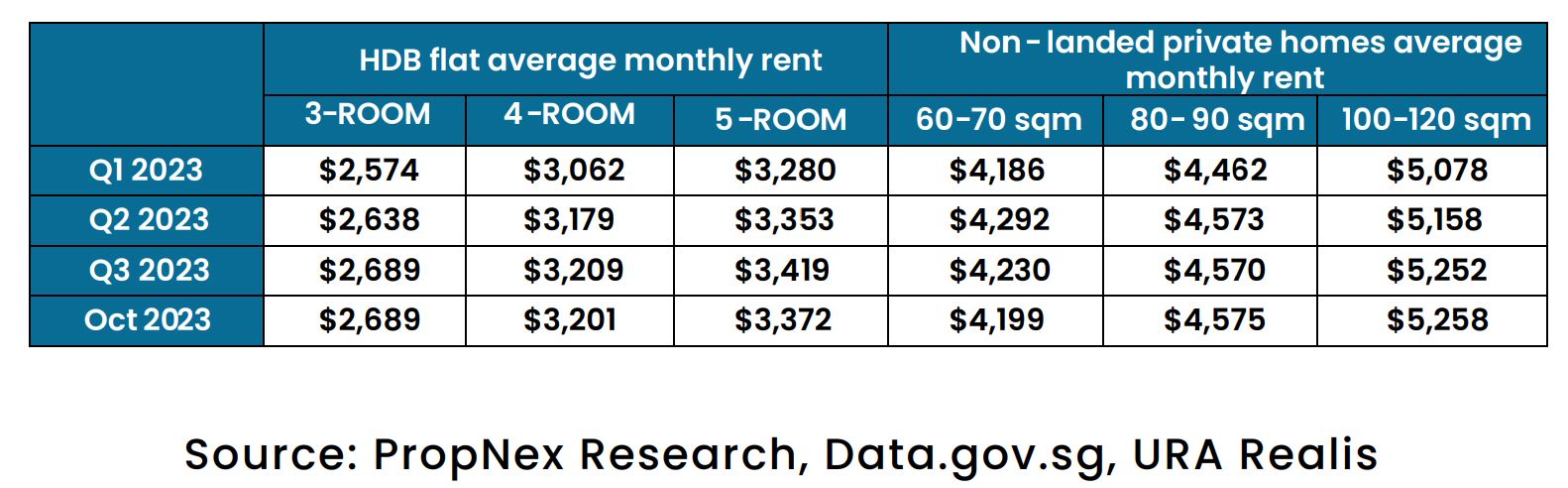

In 2023, the residential rental market saw a subdued performance in the public and private housing sectors with prices reaching a peak. Rising rents may have redirected budget-conscious tenants to the HDB leasing market, where options are cheaper.

We anticipate a stabilisation in growth of home rentals in 2024. With more completions, certain locations may see increased rental stock, giving tenants more negotiation power. As more projects complete, some tenants may not need to lease anymore, impacting lease renewals.

Rental demand may still be supported by expatriates, international students, locals seeking larger homes, those awaiting new homes, private home down-graders, and single-person households seeking privacy. However, I believe rental prices are set to dip slightly due to an oversupply of units.

In 2024, I foresee tenants to possess more bargaining power over landlords due to a greater supply of flats.

Landlords must be prepared to adjust their price expectations downwards to avoid vacancies. One possibility is for landlords to sell their units to cash out on capital gains and avoid higher non-owner occupied property taxes eating their rental profits (can be 3 month’s worth).

2024 is the year of the Dragon and I strongly believe it will be a great year if you know how to sense the property pulse and seize the right opportunities.

My advice: Those who can buy a new launch condo or exit their property in the 1st Half of 2024 will stand to gain.

I know this article is jam-packed with information and some of you are scratching your head, thinking, “What do I do now?”

No worries!

I’m offering a no-obligation free consultation so you can learn what the best opportunities are in this current market. As a real estate consultant, I listen to understand your specific needs, give you my expert advice, and serve you with my 100% commitment to make your property journey a success.

Don’t hesitate to contact me at 88316965 today!

Get In touch.