Executive Condominium: The Best Kept Secret to Exuberant Living

Written by Seth Tan

What is the big deal about ECs? It’s just another condo, isn’t it?

That was me before entering the real estate business. And, I was wrong. After some deep research and exploration myself, I realised ECs is quite a whole different ball game from your typical HDBs and Condominiums.

I am convinced Executive Condominiums is one of the best kept real estate secrets for lifestyle and wealth improvement of Singaporeans.

What are Executive Condominiums (or ECs)?

EC is a hybrid of public-private housing in Singapore that first appeared in 1999. They are developed and sold by private developers who bid for the land in Government Land Sales (GLS). Catering to the middle-income group, it was designed for Singaporeans who have exceeded the household income for HDB flats (S$14,000) yet can’t afford a private condominium that comes with its hefty price tag.

Regardless of whether you could buy a HDB or private condominium, I encourage you to seriously consider getting an EC.

Here are my top reasons.

1. Condo Living Without the Price Tag

ECs come with beautiful home designs, the whole plethora of facilities, and you honestly can hardly tell it apart from a regular private condo. Just take a look at these photos of Signature at Yishun (Completed 2017) below and Parc Canberra (Completed 2023) on the right to blow you away.

And that’s not all! You can enjoy the condo-like living at a much cheaper price! New ECs are subsidised by the government and you can even get CPF housing grants too. For the same floor size, ECs can be priced 20-30% less than a private condo, depending on its location.

2. Good Capital Appreciation

In comparison with conventional HDB flats and Private Condos, EC owners profit the most. Past data has shown that most first-time EC owners stand to gain more than $300,000 when selling their property after completing the 5-year Minimum Occupation Period (MOP), while second-time EC owners continue to gain S$261,948 on average.

That’s a pretty amazing profit, if you ask me! Definitely a star buy for those keen on investments.

I will go deeper into the analysis and statistics in another post comparing the profits gains of Private Condos versus Executive Condos.

3. No Additional Buyer’s Stamp Duty

Interestingly, when you are upgrading from a HDB to a new EC unit (not resale EC), the Additional Buyer’s Stamp Duty (ABSD) is fully waived. This is in contrast to those upgrading to a private condo as they are required to pay an upfront ABSD of 20%. Using a $1M unit as an example, that’s a whopping $200K in savings! Isn’t that a huge plus point?

But if I own a HDB and want to buy a new EC, don’t I need to pay ABSD? NO!

4. Buy Now, Pay Later

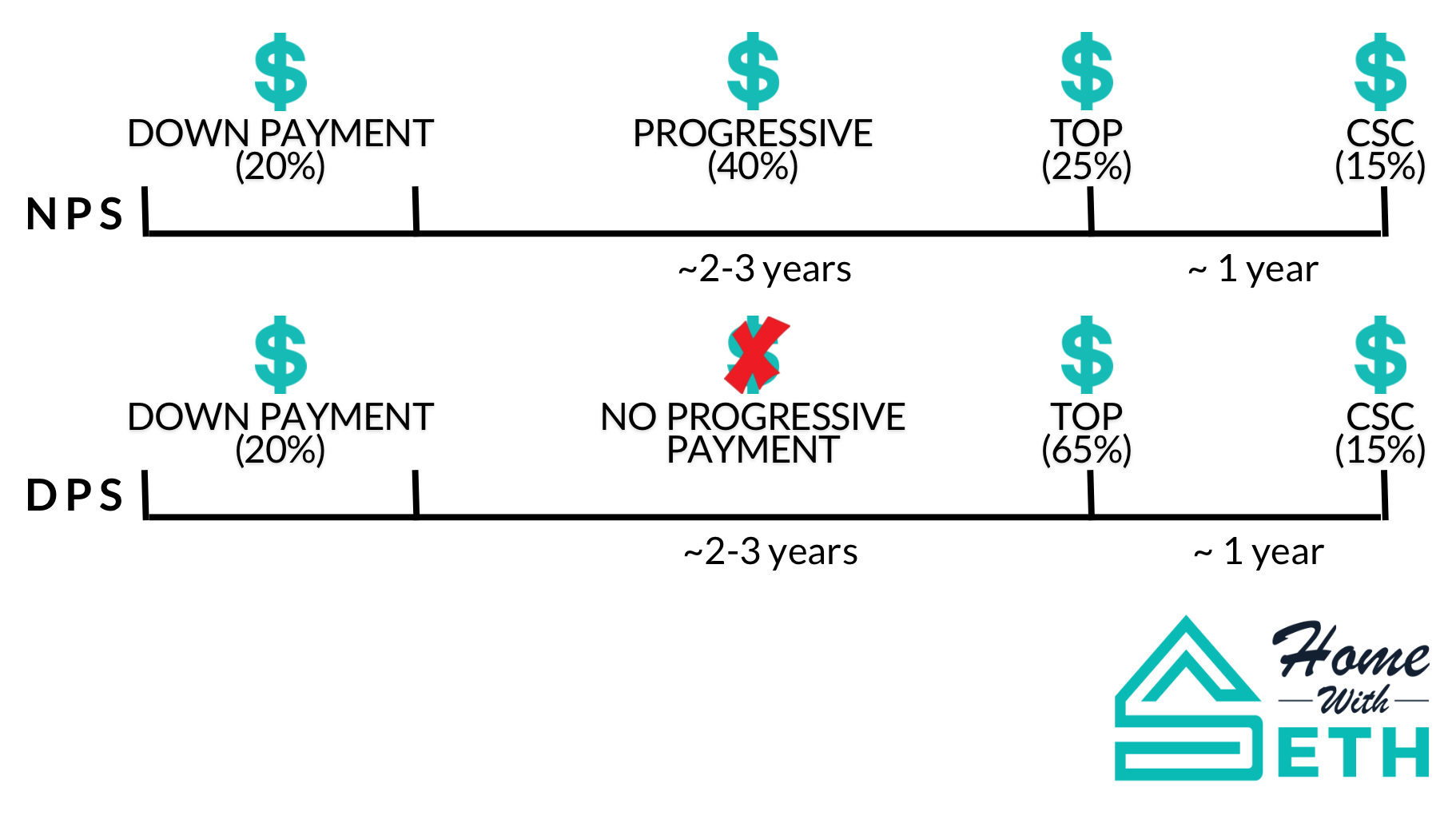

ECs usually have two payment schemes: Normal Payment Scheme (NPS) and Deferred Payment Scheme (DPS). For both schemes, you still need to pay the 20% downpayment at the start. But after that point, they differ.

For NPS, you pay progressively as the development is built. This is the same as for new launch private condos.

In contrast, if you choose DPS (and this is where New ECs have that unique advantage), you won’t need to pay until the property reaches TOP, which may be a good 2-3 years later. DPS allows owners who are servicing their HDB loans some financial relief from servicing two concurrent loans. This might also allow you to continue earning interest on your savings; however, do take note that purchase prices are marked up by roughly 3% if you take the DPS route.

“Great!! Let’s go buy an EC.”

Hang on, my friend.

Before you jump in to buy an EC, there are some things to take note of.

5. Things To Note About ECs

Eligibility

To qualify to buy an EC (new launch or resale <10yrs), at least one of the family nucleus applicants must be a Singapore Citizen (SC) and the other applicant at least a Singapore Permanent Resident (SPR). For joint singles above 35 years old, both must be SCs. Once an EC crosses the 10 year mark, it is fully privatised and can be sold to anyone (including foreigners).

There is an additional eligibility criteria for new ECs – applicants’ combined income cannot exceed $16,000/month. However, once the flat has reached the Minimum Occupation Period of 5 years, this income ceiling no longer applies.

Location

ECs are all outside the central region of Singapore while the prime central areas are taken by private condos. ECs tend to be in more ulu (faraway) areas like Yishun, Tampines, Jurong, Choa Chu Kang. Thus, if location is a big factor in your decision, you might want to reconsider ECs or pay close attention to which EC to go for. Some ECs are also not in accessible walking distance to the MRT. An example is North Gaia EC in Yishun, which will require a 20-min bus ride to reach Yishun MRT. Investment opportunity it may be, but do first ensure the EC is suitable for your daily commute and lifestyle.

Bank Loan only

If you need to take up a loan, note that you can only finance your EC using bank loans. Unfortunately, HDB loans are not permitted. This means that, compared to HDB, you will need to make an upfront cash payment of 5% in the booking fee and 15% (Cash/CPF OA) for downpayment. So do ensure you have the necessary funds first before committing.

In summary, ECs are a great choice of housing in Singapore for personal enjoyment and investment. Check out the list of upcoming EC new launches here. If you need an agent to help you navigate the purchase of ECs, feel free to contact me!

Get In touch.