At the start of this year, I wrote my 2024 Property Pulse article and my predictions were spot on in the past three months.

Here are the key details you must know to make good property decisions for the foreseeable future.

Private Residential

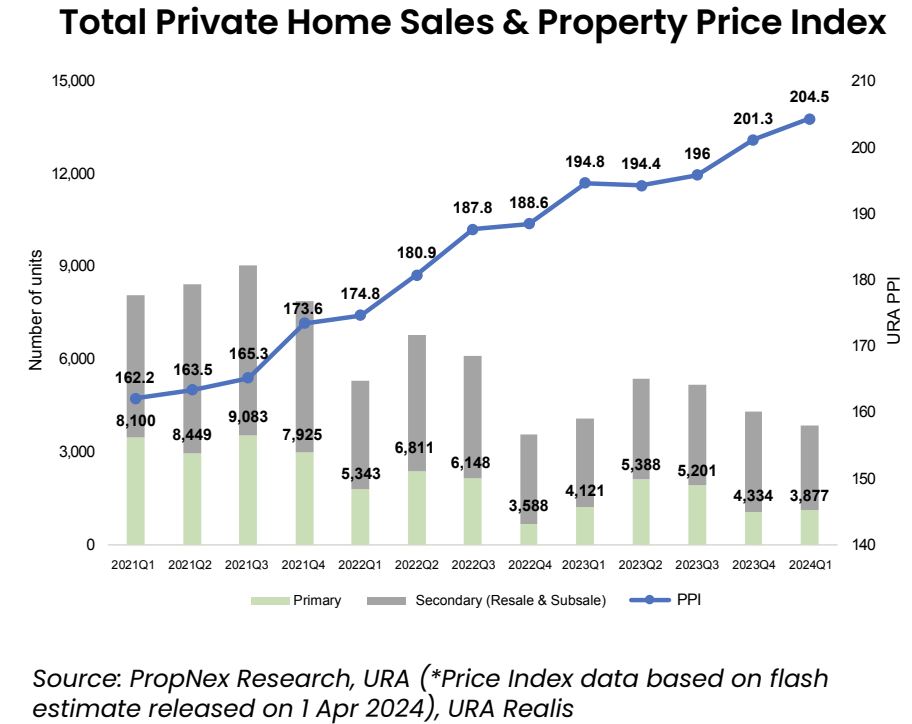

- Overall private home prices rose by 1.5% QOQ in Q1 2024, slowing from the 2.8% QOQ increase in Q4 2023 (Figure 1). Growth was spurred by the landed homes segment (3.4% QOQ). Expect private home prices to rise by a slower 4% to 5% in 2024.

- Developers’ sales got off to a slow start – in part due to the festive season and cautious market sentiment. As seen in the higher take up for Lentor Mansion (75% sold out in a single weekend) and Cuscaden Reserve (45 units sold) after price was adjusted, buyers are waiting for the right project that fits their budget and perceived value. I believe developers will price very sensitively so look out for value buys in the market. This is further corroborated by the GLS sole bids accepted below market expectations.

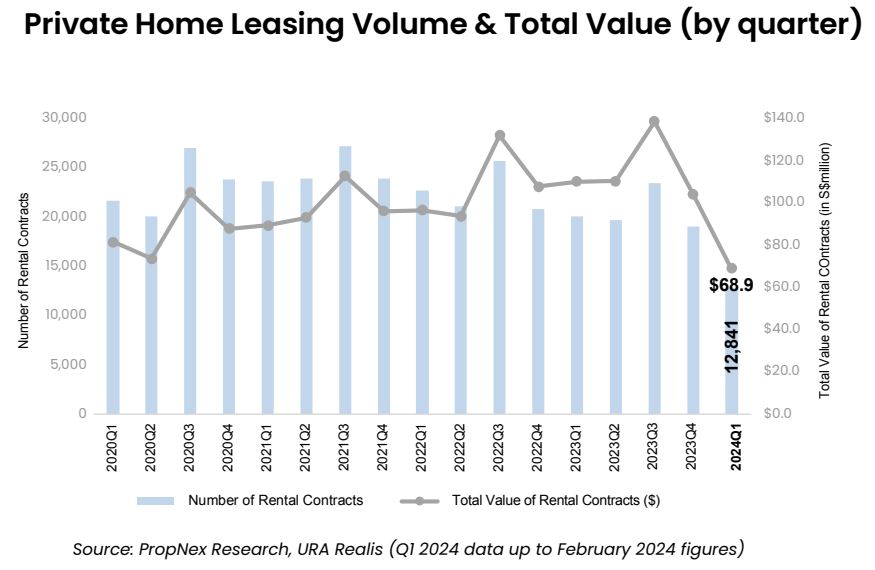

- Rental growth has eased and median rent has dropped (Figure 2). Tenants have the upper hand when negotiating rent and landlords must adjust their expectations. Expect this trend to continue in 2024 with a higher supply of newer homes entering the market and the increased temporary occupancy cap for larger flats.

Figure 1

Figure 2

HDB Residential

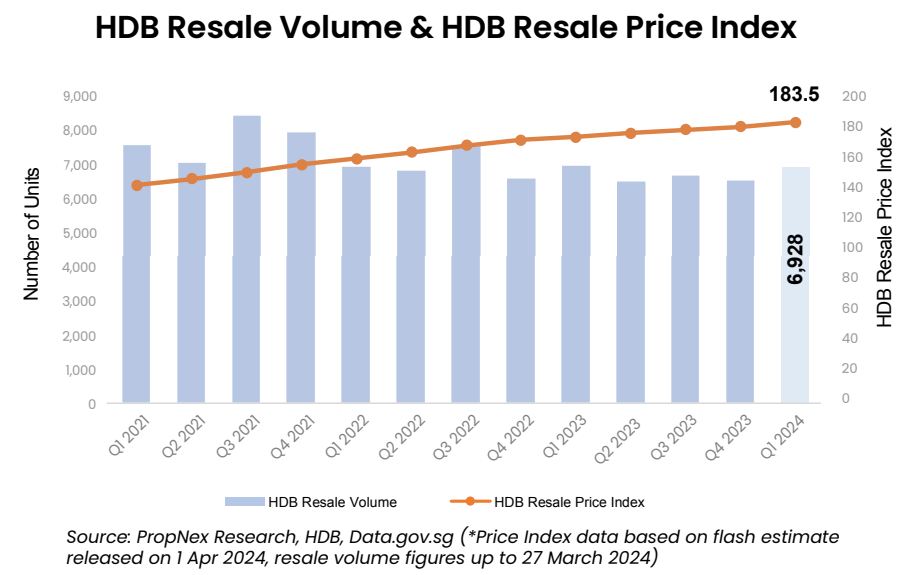

- HDB resale price index has recorded a new high of 183.5 (Figure 3). This is likely due to healthy demand, more flats being sold above $1 million, and a steady stream of newer resale flats sold. If you’re planning to buy, don’t wait for prices to drop. Expect the HDB resale market to remain stable this year, with resale prices projected to rise at 5% to 6% for the whole of 2024.

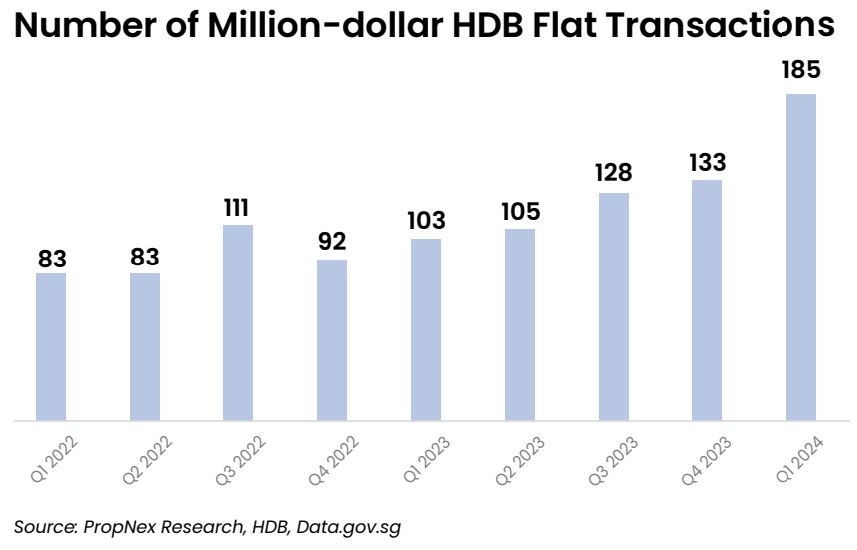

- The number of million dollar flats has risen for the fifth straight quarter (Figure 4). In fact, a 5-room resale flat in Bukit Merah just set a resale record of $1.59 million! To give some perspective, million-dollar flats accounts for 2.7% of all quarterly transactions. This could be attributed to ex-private homeowners ending their wait out period and entering the market with larger capital.

Question: Would you rather spend $1.2 million to buy a 5-room flat in a central location or a 1-bed condo in the island fringes? Let me know what you think in the comments!

Figure 3

Figure 4

If you wish to understand the property market better, I’m offering a no-obligation free consultation so you can learn what the best opportunities are. As a real estate consultant, I listen to understand your specific needs, give you my expert advice, and serve you with my 100% commitment to make your property journey a success.

Don’t hesitate to contact me at 88316965 today!

Get In touch.

Trackbacks/Pingbacks