Time flies, and we’re already halfway through the year! Do you know how the property market performed? If you like to catch-up on Quarter 1, you can read it here.

If you’re familiar with that, then let me share with you about the past three months in Q2 and opportunities you can seize.

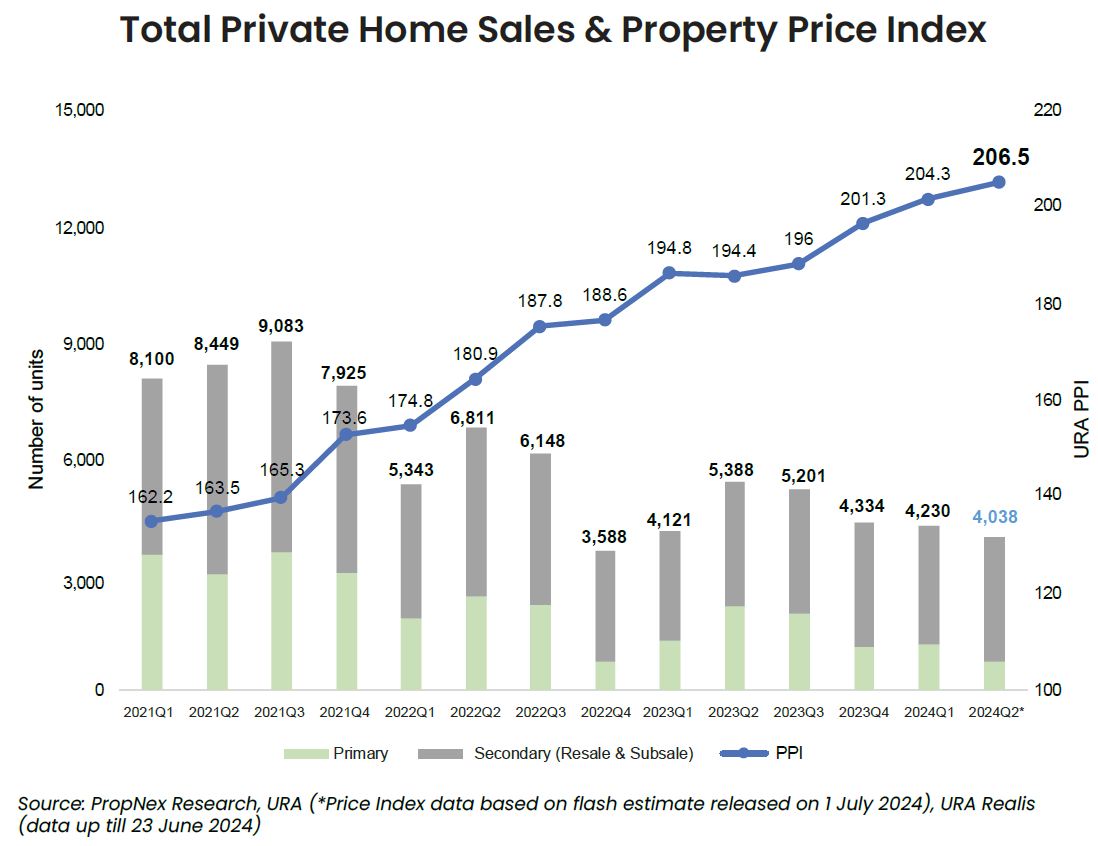

Private Residential

- Overall Market: Home prices increased by 1.1% quarter-on-quarter (QoQ), a slight deceleration from the 1.4% rise in Q1 (Figure 1). The landed homes segment led the growth with a 1.8% QoQ increase, while the non-landed segment saw a modest rise of 0.9% QoQ.

- Regional Performance: In Q2, prices in the Rest of Central Region (RCR) grew the most by 2.2%, the Outside Central Region (OCR) remained relatively stable with a 0.3% increase, while the Core Central Region (CCR) experienced a slight dip of 0.2%.

- Resale Market: Resale activity remained resilient because of 1) the limited new project launches, many of which were boutique developments and 2) a significant price gap of 40% between new homes ($2,408 psf) and resale homes ($1,719 psf). If you’re planning to buy a private home, now might be a good time to consider resale condos. If you rather to buy a new launch, keep a look out for value buys in the market as developers are likely to keep prices affordable in upcoming projects. Do engage an experienced real estate consultant to assist you.

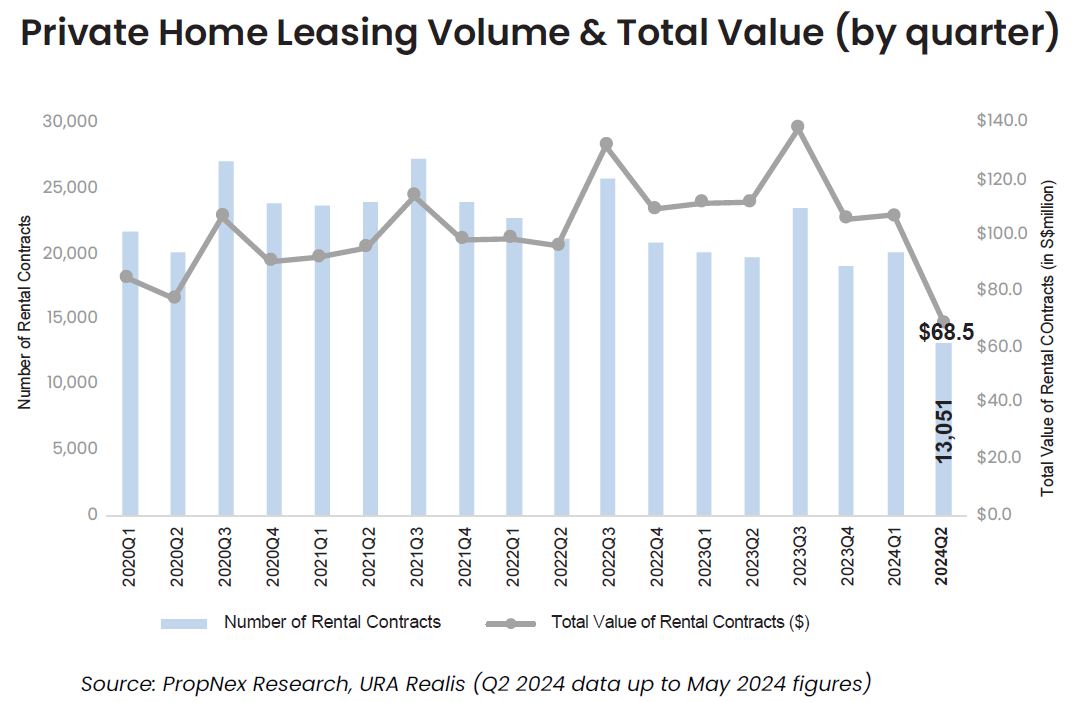

- Rentals: The rental market is expected to continue its downward trend (Figure 2) due to waning leasing demand. This moderation is driven mainly by the sharp increase in completed new homes, leading to fresh rental supply, and former tenants no longer needing to rent. If you’re a landlord, be prepared to lower rental prices in light of the softening market. If you’re a tenant, you have greater choices and negotiation power.

- Future Outlook: With slower sales, transaction volumes are expected to decline, and prices might rise by only 4-5% by the end of 2024.

Figure 1

Figure 2

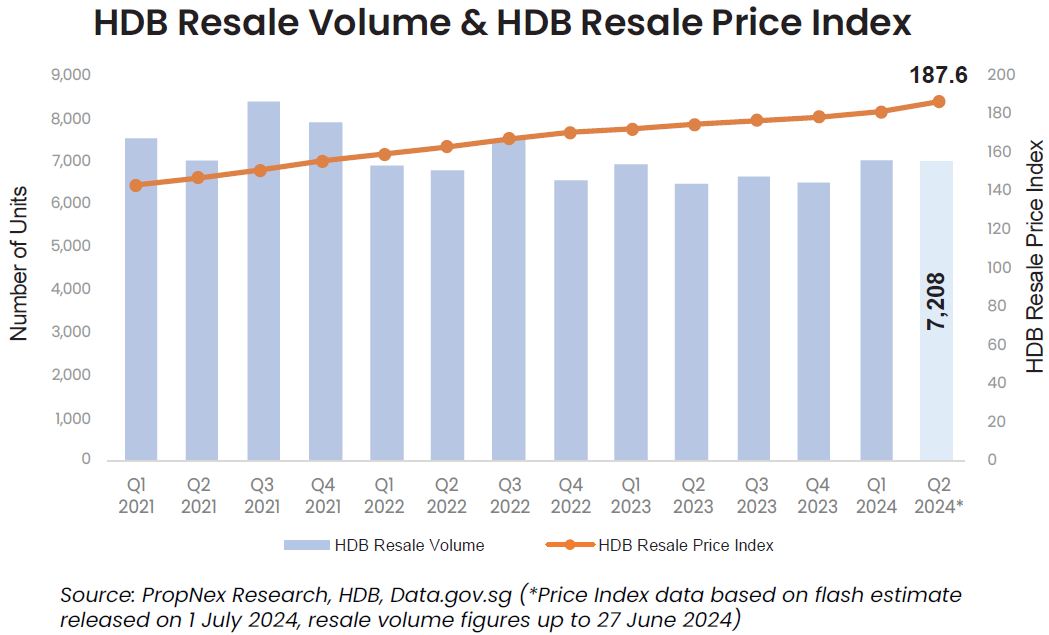

HDB Residential

- Overall Market: HDB resale prices rose by 2.1% QoQ, reaching a new high and accelerating from the 1.8% growth in Q1 (Figure 3). This price increase is likely driven by strong demand for resale flats, a higher number of flats being resold for at least $1 million, and a trend of more properties being sold at higher price ranges. If you’re looking to buy a HDB, don’t hold your breath for prices to drop anytime soon!

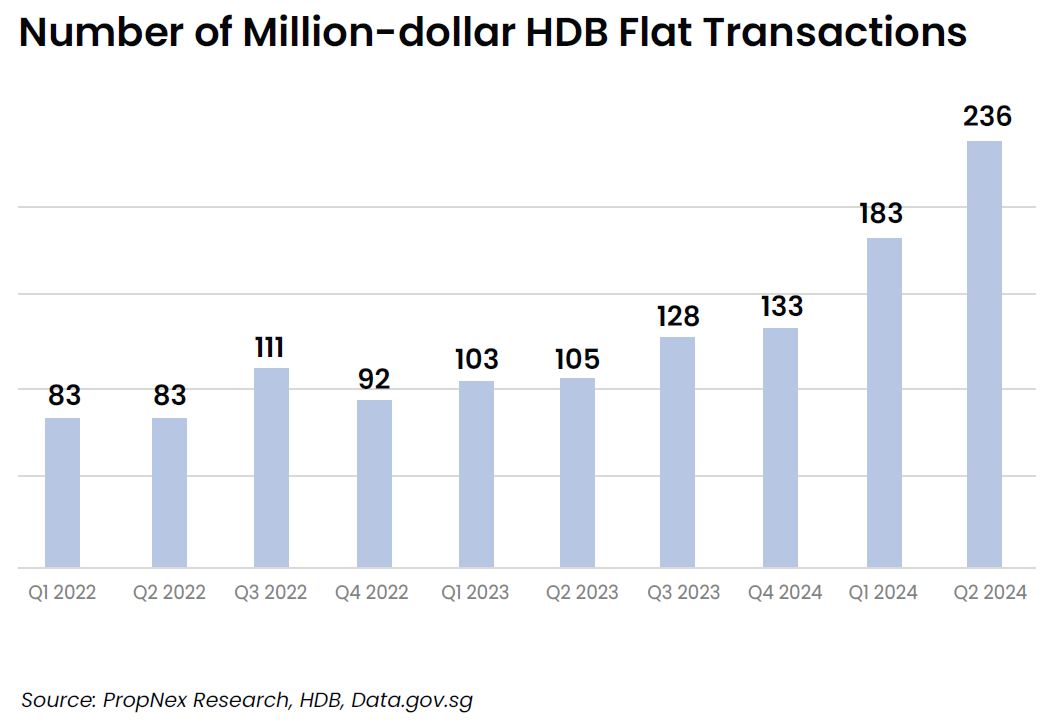

- Million-Dollar Flats: The number of million-dollar resale flats has increased for the sixth consecutive quarter, with a record 236 such flats sold (Figure 4). This brings the total to 419 units sold in just the first half of this year. At this pace, the number of million-dollar flats in 2024 could double that of 2023’s record of 469 units! Would the government intervene through cooling measures again? Only time will tell.

- HDB Flat Portal: Launched on 30 May, the HDB resale flat portal aims to curb resale property listings which have unrealistic pricing or contain misleading information. It also allows HDB owners to list their units for sale without needing a property agent’s services on property portals. Agents are still able to represent their clients on the portals although some owners will go the Do-It-Yourself route. However, navigating property decisions can be complex, underscoring the importance of consulting with real estate professionals who can provide tailored advice based on an individual’s financial situation, future goals, and the current economic climate.

- Future Outlook: I expect the demand for HDB resale flats to remain strong throughout the rest of the year, with overall HDB resale prices potentially rising by 6-7%.

Figure 3

Figure 4

If you wish to understand the property market better, I’m offering a no-obligation free consultation so you can learn what the best opportunities are. As a real estate consultant, I listen to understand your specific needs, give you my expert advice, and serve you with my 100% commitment to make your property journey a success.

Don’t hesitate to contact me at 88316965 today!

Get In touch.